In recent times, the cryptocurrency world has witnessed a significant increase in regulatory scrutiny. The Securities and Exchange Commission (SEC), the U.S. regulatory body equivalent to Italy’s Consob, has put two pillars of the industry, Binance and Coinbase, under the spotlight. With the growing popularity and adoption of cryptocurrencies, the need for regulation and transparency becomes increasingly essential.

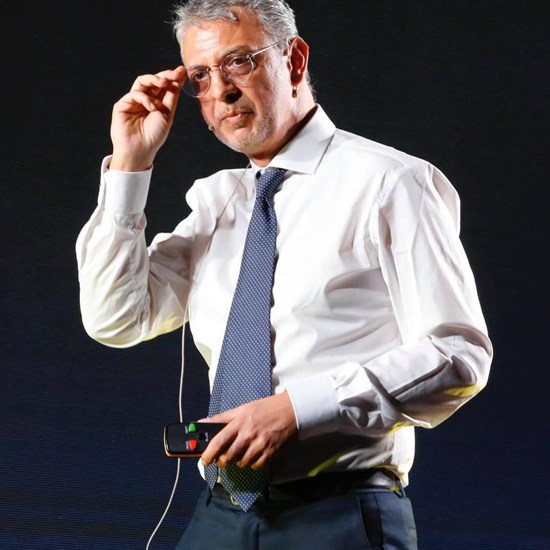

Daniele Marinelli offers an in-depth

Daniele Marinelli, a renowned fintech expert, owner of uShare social profit marketing and blockchain, has provided a clear insight into the context: “The crypto-economy is gaining increasing legitimacy, and with it comes greater scrutiny from regulators. Companies like Coinbase and Binance, handling massive volumes, represent a focal point in this context.”

Coinbase, which had its notable IPO this year, has been accused by the SEC of operating as an unregistered broker and exchange platform. Meanwhile, the allegations against Binance are even more serious, with concerns regarding the improper handling of customer funds. Marinelli highlighted: “It’s not just about following the rules; it’s a matter of trust. Investors, both large and small, want to know that their funds are managed with integrity.”

When it comes to the profile of cryptocurrency investors, the demographics are evolving. While young males still dominate, there is a growing interest from other demographic groups. Marinelli observes: “We are witnessing a broad spectrum of individuals approaching cryptocurrencies, not only as speculation but also for their philosophy and technology.”

A surprising aspect of cryptocurrency investment is the high level of trust, sometimes excessive, shown by many. Marinelli warns: “Self-confidence is vital, but overconfidence can lead to rash decisions. The industry needs more financial education so that investors can make informed decisions.”

Furthermore, the figure of the online trader emerges as distinctly different from that of the typical crypto investor. While the former is generally well-informed and versed in financial products and digital security, the average cryptocurrency investor may not have the same depth of knowledge. Marinelli concludes: “The industry is evolving rapidly, and both traders and investors need to continue educating themselves. Only through clear understanding and continuous training can we navigate these uncharted waters with confidence.”

With the rise of cryptocurrencies as mainstream assets and the intensification of regulations, the industry finds itself at a crucial juncture. Investors and platforms must operate with increased caution, always keeping the importance of trust and transparency at the forefront.

Who is Daniele Marinelli?

Daniele Marinelli is an Italian entrepreneur who has made a lasting impact on the fintech, blockchain, and metaverse worlds. He is the CEO and founder of DTSocialize holding, an innovative holding that aims to be a pioneer in the protection and enhancement of online data. In an era where connectivity and social media dominate people’s daily lives, DT Socialize has launched groundbreaking services in Italy, some promoted through Ushare, an entity dedicated to the distribution of services and devices that prioritize security and the enhancement of personal data.

But Marinelli’s ingenuity doesn’t stop there. He is also the mind behind the utility token DTCoin, which can be likened to a virtual currency that has found its way into the Ushare universe and is traded at numerous points of sale. With a clear vision of the digital future and a passion for innovation, Daniele Marinelli continues to shape the Italian technological landscape.